Award Winning

London Asian Wedding Caterers

London Asian

Wedding Caterers

We believe every celebration deserves to be exceptional. As a premier catering company in London, we specialise in crafting unforgettable culinary experiences, allowing you to be a guest at your own event.

Welcome To

Elite Event Caterers

Your Vision | Our Expertise

Elegant Asian, Indian, Pakistani, and Bangladeshi Catering and Event Planning

Our commitment to excellence, combined with our chefs' mastery of authentic Indian and Pakistani cuisine, ensures that every dish is a masterpiece, and every event is a resounding success.

Uncompromising Standards

We hold ourselves to the highest standards of quality and service, ensuring every detail is meticulously executed.

Culinary Expertise

Our team of talented chefs brings years of experience and a passion for creating delicious, authentic Asian dishes with the ability to create modern fusion dishes.

Tailored Experiences

We understand that every event is unique. That's why we work closely with you to create a customised menu and experience that perfectly reflects your vision.

Client Satisfaction

Our reputation is built on the satisfaction of our clients. We consistently receive rave reviews for our exceptional food and service.

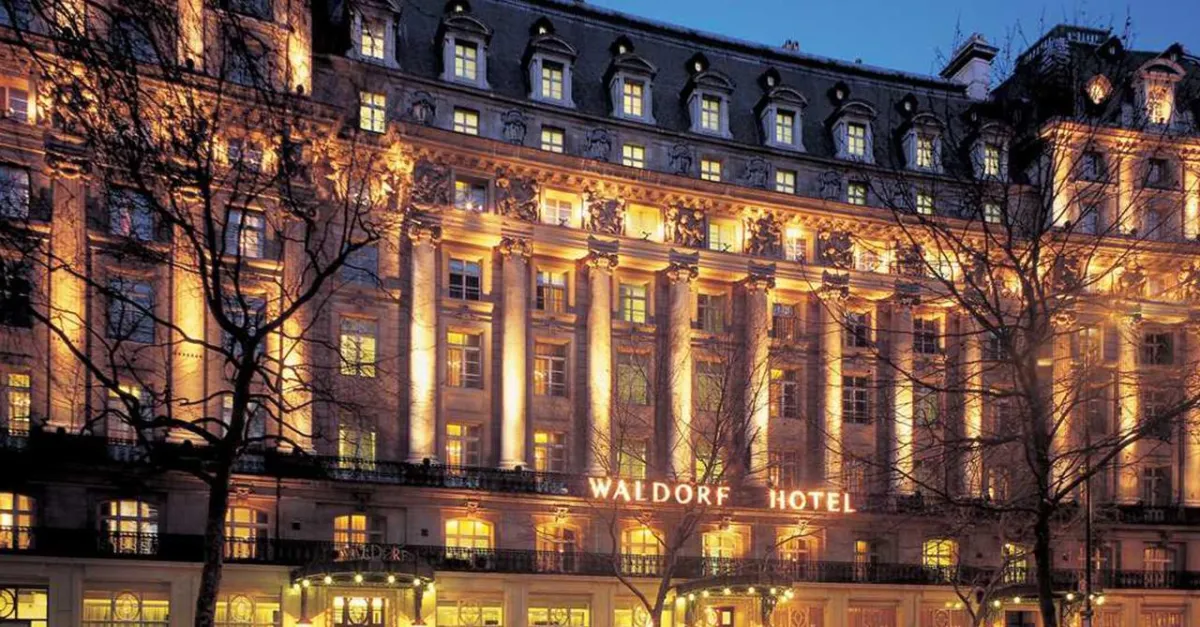

Luxury Venues | Timeless Memories

Wedding Venues

Over the years, Elite Event Caterers have forged excellent relationships with some of the most prestigious event venues across the country. Our portfolio is regularly updated, offering a wide range of options.

There really is a setting for every occasion. From the extravagance and grandeur of a 5 Star Hotel or a Country Manor House, to more intimate venues, you really are limited only by your own imagination.

Let your imagination run wild, and let Elite Event Caterers provide an unforgettable dining experience for you and your guests.

Extensive Venue Network

Elite Event Caterers has cultivated strong relationships with numerous prestigious event venues nationwide.

Diverse Venue Portfolio

Regularly updated portfolio of venue options in London and Essex, catering to diverse event styles and sizes.

Unleashing Creative Possibilities

They empower clients to realise their event vision, from grand 5-star settings to intimate locations, providing an unforgettable dining experience.

Halal caterers | 5* Authentic cuisine

We’ve Got You Covered

We are Asian Caterers and we are offering bespoke wedding catering packages. Being a Halal Caterers we insure that we provide HMC products to give complete peace of mind to all of our muslim clients.

Our exquisite “five star” catering is a core element of The ELITE offering and a key reason why our clients choose to host their event with us.

Delectable dishes that exude mouthwatering flavours are prepared with premium hand picked ingredients, under the expertise of our talented chefs to create delightful menus, ensuring that the catering will be a delight for you and your guests.

READY TO Discuss your special event?

Our Event Catering Promise

We are committed to exceeding your expectations and creating an unforgettable culinary experience for you and your guests. From tantalising tastes to impeccable service, Elite Event Caterers is your trusted partner for all your catering needs.

Want To Discuss Your Event

With Our Team?

Let our expert team simplify your event planning.

Contact us for a consultation and discover how we can create a memorable experience

Copyright 2025. Elite Event Caterers | 5* Asian Catering For All Events. All Rights Reserved.